Hawaii Insurance Commissioner Does No Favors for Genworth Long Term Care Insurance Policyholders

By John H. Robinson, Financial Planner

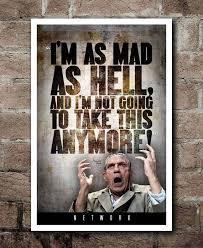

Genworth Long Term Care Policy Holders Should be “Mad as Hell.”

The 1976 film “The Network” featured the iconic line from a disgruntled newscaster, Howard Beal, shouting from the top of his lungs, “I am as mad as Hell and I am not going to take it anymore.” In my opinion, this refrain should be echoed not just by Genworth policyholders but by all residents of Hawaii, and the sentiment should be directed to Hawaii’s insurance commission at the Department of Consumer Commerce Affairs (DCCA).

In December (2023), I posted an article on the Financial Planning Hawaii blog titled, “3 Villains, No Heroes The Genworth Long Term Care Insurance Saga.” In that piece, I chronicled the roles that Genworth Life (formerly GE Life), the law firms that negotiated self-serving class-action settlements, and the state insurance commissioners, who must approve all premium increase requests, have played in inflicting financial and emotional stress on Hawaii consumers who purchased LTC policies from Genworth in the 1990s and 2000s. In that article, I noted that while the state insurance commissions have largely escaped public criticism and accountability, “In some ways, the insurance commissioners may even be the worst villains in the Genworth LTC saga.” The recent approval actions by Hawaii’s Insurance Commissions serve as Exhibit A in supporting the position.

Specifically, in December 2023, the Hawaii Insurance Commission approved premium increases of 71.7% (to be phased in over three years) for Genworth Choice LTC policies with limited benefit periods and 131% (to be phased in over four years) for policyholders with lifetime benefit periods. This approval marked the 7th premium increase policyholders have been forced to endure since 2008. Also in December, the Commissioner approved 38.9% (to be phased in over two years) for Genworth Choice II LTC policies with limited benefit periods and 114% for policies with lifetime benefit periods (to be phased in over 4 years) for Genworth. This approval represents the 8th approved premium increase since 2008. For consumers who have already seen their premiums double or triple or more over the past 15-20+ years, the magnitude of these latest increases is simply unmanageable.

The Role of the Insurance Commissioner

According to the National Association of Insurance Commissioners, the standard-setting organization governed by the insurance commissioners from all 50 states (plus the commissioners from the District of Columbia and five U.S. territories), the commissioners are “united in their shared commitment to set standards to ensure fair, competitive, and healthy insurance markets to protect consumers.”

A review of the actions by the insurance commissions around the U.S., including Hawaii, finds that they have almost universally gone out of their way to support the interests of the insurance companies, but have done precious little to protect consumers. For example, in a June 2023 publication, – Long Term Care Insurance – Looking Back and Thinking Ahead, New York Insurance Commissioner Adrienne Harris waxes sympathetically about how insurance companies who developed and introduced LTC insurance in the 1980s can be forgiven for mispricing their products because they did not have experiential data to guide their pricing decisions. Specifically, she cites underestimated lapse ratios and the failure to anticipate the number of policyholders who would file claims as key contributors to underpricing.

In my opinion, this position is extraordinarily naïve. As a young financial advisor in the 1990s, I sat in on a number of sales seminars hosted by GE Life (now Genworth Life) and other carriers. At all the meetings I attended, a primary selling point was that “at least 1 in 3 Americans over age 65 will need long term custodial care in their lifetimes,” so to suggest that the insurance companies did not anticipate claims is simply not accurate.

Additionally, the impetus for the introduction of LTC insurance in the early 1990s was the life insurance industry’s profit-motivated desire to take advantage of the coming wave of baby boomers who were rapidly approaching retirement. It seemed to me at the time that the mispricing was not due to actuarial miscalculations but rather to the carriers competing amongst themselves for market share. GE Life was arguably the most aggressive in its predatory pricing behavior as its management sought to implement GE CEO Jack Welch’s mantra of being #1 in every market. This example of the voices of the insurance companies’ marketing departments drowning out the recommendations from the actuarial department is hardly unique. A similarly driven mispricing of variable annuity living benefit riders took place in the early 2000s and came back to haunt the issuers during the 2007-2009 financial crisis.

In terms of fairness, a nuance that seems to be lost on the NY Insurance Commissioner is that consumers who attended long term care insurance seminars were consistently misled in the sales presentations. In meetings I attended in Massachusetts when I was a rookie financial advisor with A.G. Edwards & Sons and later when I was with Citigroup/Smith Barney in Honolulu, consumers were proactively encouraged to purchase their policies when they were still in their 50s or early sixties 60s in order to lock in lower premiums. While most of the presenters disclosed that the contracts permit the issuer to increase premiums in the future, both the likelihood and magnitude of such increases were unambiguously downplayed. At every meeting I attended, consumers were left with the impression that premiums were not likely to increase.

As for the insurance commissioners’ obligation to maintain a fair and healthy long term care insurance market, it is increasingly clear that traditional long term care insurance represents a failed product innovation. The fundamental reason long term care is a poor risk to insure is due to the high potential cost of claims paired with a high likelihood of occurrence. Evidence that the market for traditional long term care insurance is effectively dead is provided in the Hawaii Insurance Commissioner’s 2023 annual report. In it, the Commissioner writes, “The majority of insurers with rates and forms on file in Hawaii no longer actively sell standalone long-term care insurance, though they continue to service existing policyholders.”

The State Insurance Guaranty Fund is the 800 lb Gorilla in the Room

Given the information I have shared above, the question that begs asking is “Why have the state insurance commissioners almost completely ignored their obligations to protect consumers by forcing them to bear the cost of the insurance companies’ irresponsible sales and pricing behavior?” The inconvenient truth is that the insurance companies, particularly Genworth (which had the largest share of the LTC marketspace), are simply too big to fail.

The Hawaii Life & Disability Insurance Guaranty Association promises that policyholders who purchased LTC policies issued in Hawaii will receive up to a maximum of $300,000 of benefits for qualifying claims. Although I have no quantitative data to support this assertion, my guess is that if Genworth were to fail (i.e., file for bankruptcy protection), consumer benefit claims would potentially exhaust the guaranty fund, or, at the very least, discourage the active insurance companies that pay premiums to the guaranty fund from doing business in the state. Discussion of this possibility has been almost entirely absent in public forums, which makes the “800 lb. Gorilla” characterization seem eminently apt.

Why Hawaii Genworth Policyholders Should Be Particularly Aggrieved

While the too-big-to-fail argument may shed light on why the Insurance Commissioners' responses to the LTC insurance crisis have almost entirely favored the insurance carriers at the expense of consumers, in my opinion, the Hawaii Insurance Commission’s latest approvals represent a uniquely egregious failure to meet the agency’s obligation to protect consumers.

As part of the terms of the class action settlements (Haney v. Genworth, Halcom v. Genworth, and Skochin v. Genworth), Genworth agreed to notify policyholders of the total amount of future premium increases it expects to request from the state insurance commissions over the remaining life of each policy class. As the insurance commissioners are quick to point out, when increase requests are submitted, the insurance carrier is required to provide the actuarial basis for the increase. If the amount of the increase is consistent with the actuarial models, the insurance commission is obligated to approve the request.

In the case of the Hawaii request, instead of implementing increases over the lifetime of the policy class, it appears that the Hawaii Commissioner elected to permit Genworth to institute the total amount of its projected need all at one time (albeit over a short phase-in period). This assessment is supported by the Insurance Commissioner’s insistence in its approval notice that “[Genworth] agrees that no further rate increases will be presented to the Division.”

It should come as no surprise that policyholders who have paid premiums for 10-20 years or more and have already endured 6-7 major premium increases view the impact of a new round of 38.9%, 71.7%, 114%, or 131% premium increases as a catastrophic blow. I expect the vast majority of these policyholders will either elect to invoke the non-forfeiture rider,if applicable (i.e., elect to convert their contracts to paid-up policies with a benefits pool equal to the amount of premiums paid), or simply terminate their policies.

Why This Impacts ALL Hawaii Taxpayers – MEDICAID

The consistent rubber-stamping of premium increases by the Hawaii Insurance Commissioner culminating in a final massive death blow will probably serve the intended purpose of clearing Genworth Life’s books of most of its potential future long term care claims liabilities. The Hawaii consumers who purchased Genworth LTC policies in good faith and allocated an ever-increasing portion of their retirement incomes and savings are obvious victims, but they are not the only ones.

Ironically, a primary reason why many people purchased these policies was to help them avoid Medicaid and/or becoming a burden to their families. After paying premiums for 10-20 years or more on policies they can no longer maintain, these people are now more likely to find their way to the state’s Medicaid roll. Medicaid is one of the largest portions of Hawaii’s state budget. To the extent that the Hawaii Insurance Commission’s actions may increase this cost, it is a burden for all Hawaii taxpayers.

Summary - What Can Consumers Do to Express Their Views?

The purpose of this essay has been to raise Hawaii residents’ awareness of the ramifications of the Hawaii Insurance Commission’s recent decision to foist a final massive premium increase on thousands of beleaguered local Genworth LTC policyholders. Unfortunately, the premium increases have already been approved, and no amount of consumer protests can undo them. However, consumers may do well to reach out to their state senators and representatives to encourage them to consider the impact of these recent rate actions on the state’s Medicaid budget and to perhaps stave off future rate actions on other classes of Genworth policies.

Related Reading:

2023 Annual Report of the Insurance Commissioner of Hawaii (page 9)

New York Insurance Commissioner Report – Long Term Care Insurance – Looking Back and Thinking Ahead (6/7/2023)

John H. Robinson is the owner/founder of Financial Planning Hawaii and Fee-Only Planning Hawaii, and he is a co-founder of software maker Nest Egg Guru

Related Articles by This Author

3 Villains, No Heroes – The Genworth Long-Term Care Insurance Saga

Should You Accept a Genworth Long-Term Care Insurance Settlement Offer?

What if the Company that Issued my Long-Term Care Policy Fails?